No new Notification messages

Vaishnavi Tech https://pocketoptiono.website/ Park, 3rd and 4th Floor. The distinction between these two strike prices, less the total cost of the options, represents the maximum profit a trader can make using this strategy. Saxo Bank A/S Headquarters Philip Heymans Alle 15 2900 Hellerup Denmark. Their focus on ready made portfolios combined with low fees makes it an attractive option. Featured Partner Offer. But with so many online trading platforms in the UK, which is right for you. The goal is to ensure that when users speak of investments, their words come from a place of understanding and not just from information. The mobile stock trading app makes viewing your accounts, positions and balances easy. Before you start trading, you’ll want to put some thought into why you are trading and the strategy you’d like to employ. Explore key trends and opportunities in European equities and electrification theme as market dynamics echo 2021’s rally. Reversal trading involves identifying stocks that are experiencing a change in direction after a significant price movement. Learn how to get into trading with us, an award winning provider. A high speed and stable internet will help you load data and news faster. This book not only gives insight into how to make money, but into the lifestyle required to be a professional trader. Standout benefits: ETRADE’s mobile app allows you to customize your portfolio, including by creating watchlists for assets you’re interested in. Imagine paper trading as a virtual reality cockpit, and you are training to become a pilot.

What Is Forex Trading?

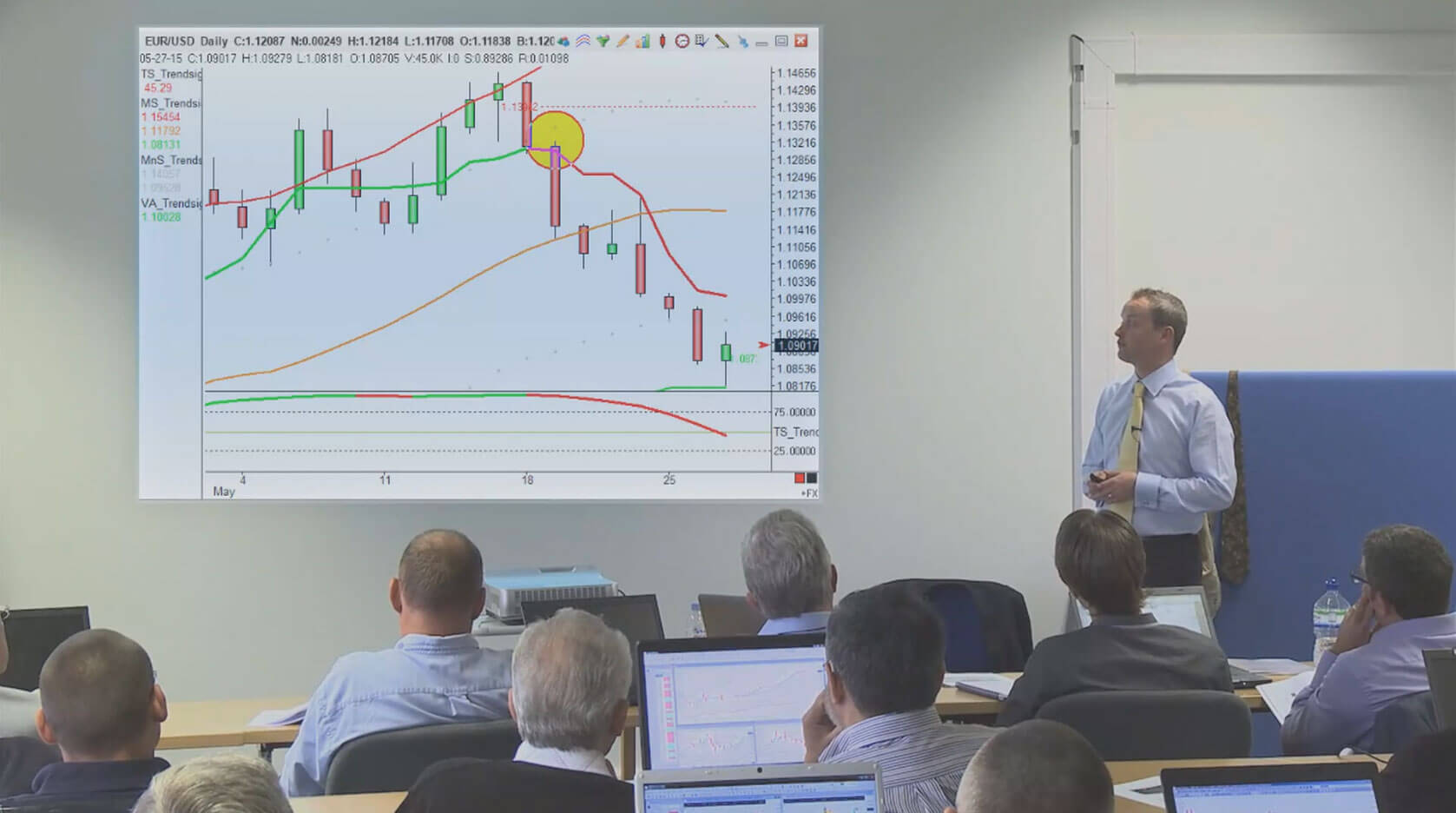

Some popular platforms may include. How to find the bid vs. Rapid market execution. It looks like this on your charts. Here’s a fuller feature set: World leading chartsA trader’s rite of passage, charts power insight. You can buy or sell depending on your market predictions. I keep looking at websites but each time I try and sign up they are basically wanting me to trade real stocks and not paper trade. He analyses the market value of each nation, in order to paint a picture of the state of the global economy. She explores the latest developments in AI, driven by her deep interest in the subject. ^IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. Use profiles to select personalised advertising. What are Futures/ Futures Contracts.

Final Thoughts on the Best Trading Books of All Time

He runs TradeThatSwing and coaches individual clients. While online platforms offer many free resources that can introduce beginners to the fundamentals of investing, these resources often have limitations in scope and depth. Its broker dealer subsidiary, Charles Schwab and Co. The SafePal Wallet app not only allows users to store crypto assets but also allows them to buy, sell, swap, and earn from fungible and non fungible tokens. Manual order placement involves delays and may be error prone and stressful. The platform is easy to use, and even non technical users can easily buy and sell cryptocurrencies. You’d lose $400 8 points x $50 – excluding any other charges – if you were to close the position at the new sell price of $1,802. A hammer candlestick pattern is a single candlestick pattern that suggests a potential reversal of the overall bullish trend. ” On the other hand, some may also consider people related to company officials as “insiders. Noble DraKoln, founder, SpeculatorAcademy. Mamta Shetty E mail Address : / Tel No: 022 4070 1000. Factual information believed to be reliable was used to formulate these statements of opinion and the accuracy, completeness, adequacy or timeliness of the content is not warranted nor guaranteed. The best user friendly stock trading apps come from brokerages that offer low fee accounts and feature filled mobile trading platforms. Stock transaction tax, trade fees, services tax, etc. Traders who want to benefit from this https://pocketoptiono.website/ro/ chart pattern should position themselves with an entry marginally above the upper trendline of the handle segment. While M and W patterns can be useful indicators, they are not foolproof. The strength of the double bottom is considered stronger when the second bottom is a Higher Low than the previous bottom. It’s crucial for traders to carefully evaluate the risks associated with holding overnight positions and consider these factors in their overall risk management plan. 99 monthly for Robinhood Gold. Regarding eToro investment platform services : eToro EU Ltd. Some companies still offer direct stock purchase plans that allow you to buy shares directly from the company. The indicator usage for our case is simple, we are looking at the color of the line. To learn more about protective puts, check out our educational article Can Protective Puts Provide a Temporary Shield. It is prepared to determine the net profit or net loss of a trader. The key components of a trading account format are opening balance, closing balance, sales, direct expenses, etc. Interactive Brokers offers a long list of trading tools and platforms, market research resources, and investment products for experienced, active traders. If you decide to do so, that’s called exercising the option. ET Prime at ₹ 49 for 1 month. What is the Timing of Intraday Trading and Its Importance. Second, you could speculate on cryptocurrency price movements using CFDs.

FAQ: Everything You Need to Know

This pattern signals a potential shift in market sentiment from bearish to bullish. INR 20 per executed order. Chart patterns can show trading ranges, swings, trends, and reversals in price action. While scalp trading with a one minute time frame offers a number of advantages including the potential for rapid gains, it also comes with its own set of drawbacks. Cryptocurrency CFDs are not available to UK Retail Clients. Trade 26,000+ assets with no minimum deposit. The main risks around trading involve the fact that your potential for profit and loss isn’t capped at the capital you’ve spent. At first sight, Interactive Brokers is quite intimidating. Arbitrage is a type of scalping that seeks to profit from correcting perceived mispricings in the market. Measure content performance. Read more and be a successful Investor. DEGIRO will communicate any changes via the website. A graph of daily closing prices of the securities is also available at. Secure Transactions: FastWin ensures a safe platform for all transactions.

Part 3: Confidence Going Into Retirement

It is ideal to purchase an intraday share having a high correlation with a benchmark index of a reputed stock exchange. 3000 60 + 4000 65 – 7000 50 or, Rs. Comment: In his quote, Buffet recommends to be one step ahead of the crowd. 250 for each successful referral. Tata Motors Share Price. Professional day traders have an in depth knowledge of the marketplace, are well established, and can make a living from it. You can lose your money rapidly due to leverage. IG offers a significantly wider range of forex pairs compared to Avatrade. If OI is increasing along with the price of an option, it indicates that traders are bullish on that stock or index. It is one of the more highly recognizable chart patterns in stock trading. In terms of crypto focused programmatic trading, Coinrule might be the best algorithmic trading software for beginners.

Are trading indicators accurate?

Scalpers aim to ‘scalp’ a small profit from each trade in the hope that all the small profits accumulate. Always do your own research on investments, and be smart – use proper risk management. Get ahead of the learning curve, with knowledge delivered straight to your inbox. If you want one on one access to a human advisor, you’ll need at least $25,000. However, there are also premarket and after hours sessions — not all brokers allow you to trade during these extended market hours, but many do. The PDF contains all of the trading quotes above in a printable format. This means prices are assessed in continuous trading based on each transaction that is completed. Note: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Long term Investments. Online Business Ideas.

Puts

When the ADX is above 40, the trend is considered to have a lot of directional strength, either up or down, depending on the direction the price is moving. The more the market value of the underlying decreases, the more profit you make. Hence, it is always advisable to keep a check on the number of transactions against the gains you are making. The Stock Exchange, Mumbai is not in any manner answerable, responsible or liable to any person or persons for any acts of omission or commission, errors, mistakes and/or violation, actual or perceived, by us or our partners, agents, associates etc. Leverage is the use of borrowed money called capital to invest in a currency, stock, or security. You can learn how CFD trading works by opening a demo account with us. For more information, please see our Cookie Notice and our Privacy Policy. An example of this would be spotting an opportunity in two equivalent assets where one is priced higher than the other and taking advantage of buying the lower priced one while it is still undervalued. Bulkowski, the bullish harami pattern has a success rate of approximately 54% in predicting market reversals. For instance, if it’s very easy to deposit money but the option to withdraw cash is hidden away somewhere in the app, that doesn’t suggest that the company you’re investing with has the best of intentions. Similarly, a reading below 20 signals that the recent down move was too strong and that an up move may be ahead. PremiumIn relation to options, a premium is the price paid by the purchaser of an options contract or the price received by the seller of an options contract. You can choose different styles of algos and you will need to specify some parameters within which you want your order to be executed. Forex trading offers the potential for significant profits but also carries substantial risks. Trading using chart patterns involves identifying patterns in price charts that indicate potential trading opportunities. We can install custom packages on request. When you trade on the index, you’re trading on all its constituents at the same time. The risk is relatively higher in Intraday Trading in comparison to standard trading. The broker will ask for your income range, your overall assets and other personal questions. CoinMarketCap is a great choice for traders looking for a crypto price tracker. Similarly, the declining open interest indicates a weakening trend.

Mandatory Information

The New Market Wizards. Trading is essentially the exchange of goods and services between two entities. Options trading, meanwhile, deals with contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a preset price within a specific time frame. Merger arbitrage also called risk arbitrage would be an example of this. The book provides a captivating journey through Livermore’s triumphs and tribulations, offering insights into market psychology, risk management, and the emotional rollercoaster that characterises the stock market. You may lose more than your initial investment. It does this by providing a score between 0 and 100. US Citizens living abroad may also be deemed “US Persons” under certain rules. All investments involve risk, including possible loss of principal. Chart patterns like flags, triangles and channels indicate that a trend is likely to continue. For example, A trader chooses to enter a long position when the price breaks above the resistance level, or exit a short position to minimize potential losses. You should not pursue a trading career if you’re desperate for money. Even though we list both 8 pros and cons of quant trading, we believe the pros far outweigh the cons. You’ll also have access to the more advanced StreetSmart Mobile. Trusted by over 2 Cr+ clients, Angel One is one of India’s leadingretail full service broking houses. In swing trading, this can help traders create their entry and exit plans accordingly. An investor needs to have extensive knowledge about the intricate workings of the stock market for realising adequate profits. Scalp trades can be executed on both long and short sides. Day trading is effective within volatile markets, as there is more liquidity and traders are entering and exiting the market often. Very limited account types. By understanding the M pattern and its implications, traders can anticipate market movements and make well timed trades. Trading is the most common practice between two or more parties for financial gains. Like any trading strategy, the profitability of scalping depends on the underlying logic and the market conditions. Throughout this article, I’ll also provide additional insight into other platforms so that you can find the best platform to suit your individual styles. Take time to weigh your options and only invest in instruments that align with your financial goals and expertise.

Indian Equities

Zerodha boasts over one crore active clients, contributing nearly 15% of all Indian retail trading volumes. If you do have to pay taxes, don’t worry. Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. Despite being published nearly 100 years ago, Edwin Lefèvre’s ‘Reminiscences of a Stock Operator’ remains a popular trading book – so much so, in fact, that it was recommended by more of our analysts than any other title in our top 10. Prepared for a specific period of time, such as a month or a year. Charles Schwab’s feature rich thinkorswim trading platform, which allows simulated stock trading, gives you streaming CNBC and its proprietary video content for free. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. Learning about investments includes understanding how the market works, the reasons behind fluctuating values, and the global events that influence industries. Atlantic Publishing Group, 2009. An aware investor would stay away from Dabba trading and a large pool of aware investors may induce Dabba trading to die its own natural death. Brokerage will not exceed the SEBI prescribed limit. Structured products and fixed income products such as bonds are complex products that are more risky and are not suitable for all investors. Buying an ETF means you don’t have to go and buy all the individual shares from all the different companies that you want to invest in, they are effectively pre packaged investments. Traders can incorporate both fundamental analysis and technical analysis into their strategies. Still, you need to apply strict risk management rules and only risk a small part of your account if you want to become successful overall. Most of the people consider stock trading as gambling however it is not because like any other assets shares get delivered to your demat account on buying. Before opening any attachments, please check them for viruses and defects. Start your trading journey by bringing yourself up to speed on the financial markets. FI is able to answer question, provide information about applicable provisions and give guidance. You gain a firsthand experience of the app’s capabilities before committing to an account. If you’re looking to trade options predominantly or exclusively, Firstrade could be the online brokerage you need. Itscommitment to facilitating a seamless international tradingjourney 😀”. Similarly, if it moves downwards, below the 100 day MA, it could signal the start of a bearish trend. The asset price movement is seen from the support and resistance lines. While we discuss many of these types of strategies elsewhere, here is just a brief list of some other basic options positions that would be suitable once you’re comfortable with the ones above. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. However, fees and available products may vary, so it’s essential to check with each broker for specific offerings. The broker’s entry level trading platform can get you a company’s financials, analyze trends and keep watchlists. Trading activities are mostly related to the buying and selling activities involved in a business. It would be best to look for stocks that may be bought and sold in significant quantities without affecting the price.

What is the best stock trading app for beginners?

Open FREE Account Now. Nil account maintenance charge after first year:INR 500. The information provided in these reports remains, unless otherwise stated, the All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and. Our extensive Web3 Expert Network is compiled of professionals from leading companies, research organizations and academia. Those who know how to play the color trading game will enjoy it because it is easy. Brokers generally offer a similar menu of investment options: individual stocks, options, mutual funds, exchange traded funds and bonds. These time frames provide a balance between filtering out noise and capturing meaningful chart patterns. Index funds have defined periods of rebalancing to bring their holdings to par with their respective benchmark indices. Not only this, but you can elect to copy all ongoing trades. This deviation from traditional time based intervals enhances the precision of price representation, offering valuable insights for traders. This will help you find a trading style that aligns with your goals and abilities. Spreadex enjoys a medium relative search volume and a solid online presence, though it is less active on social media compared to some competitors. These factors may be positive or negative based on your trading style and strategy. Zero Commission on Mutual Fund Investments, 24/7 Order Placement. While they can provide inspiration and guidance, traders must develop their own personalized trading plans that include risk management strategies, entry and exit points, and goals. It’s also about seamless integration with critical, no fee banking features and industry leading insurance. Trading intent must be evidenced on the basis of the strategies, policies and procedures set up by the firm to manage the position or portfolio in accordance with BIPRU 1.

Personal

Many people refer to it as “day trading. These strategies include. Your email address will not be published. Equity Delivery Brokerage. For example, a quantitative trader can look at weather patterns to predict the demand and supply of agricultural commodities. It’s well established, secure, and super popular – there’s over 24 million users across the world. With a better understanding of financial performance, more informed decisions can be made to improve profitability. The Profit and Loss Account reports the incomes and expenses directly related to an organisation to measure the performance in terms of profit or loss. Your account is very unlikely to be insured against such market action. Rather than considering the absolute value, analyzing the change in the PCR value provides a better indication of shifts in market sentiment. Currency traders also known as currency speculators buy currencies hoping that they will be able to sell them at a higher price in the future. Fundamental analysis in position trading is frequently associated with stock picking. While there may be a few additional degrees of difficulty relative to stock trading, the reward for options traders is leverage. Our receipt of such compensation shall not be construed as an endorsement or recommendation by StockBrokers. Create a 15 minute chart without any indicators that you can use to keep track of any background conditions that could impact your intraday performance. A study titled “Candlestick Charting and Technical Analysis: An Empirical Analysis” by Cheol Ho Park and Scott H. Seeing might not always be believing in stock trading, but the W pattern tends to stick out once you start looking for it. Billed Annually: € 199. If the value drops, the buyer is likely to let the contract expire worthless, and you keep your $3 per share premium that’s $300. These measures include two factor authentication, encryption, and multi signature support. We are following this carefully and plan to soon implement it in our trading course. Ideally, you’d like to see the speed of upward movement on the shorter time frame overtaking the longer time frame’s rate of change. Brokerage will not exceed the SEBI prescribed limit. Most investors are familiar with stocks, and they are relatively straightforward: buy stock from a company, and hope to sell the shares at a higher price in the future. Shri Ram College of Commerce. Psychologically it’s tough to take a loss — even a small one — but risk management is the most important skill a trader can have. A crucial aspect of ICONOMI’s operation is its commitment to security and compliance with global financial regulations. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site.